Investment Summary

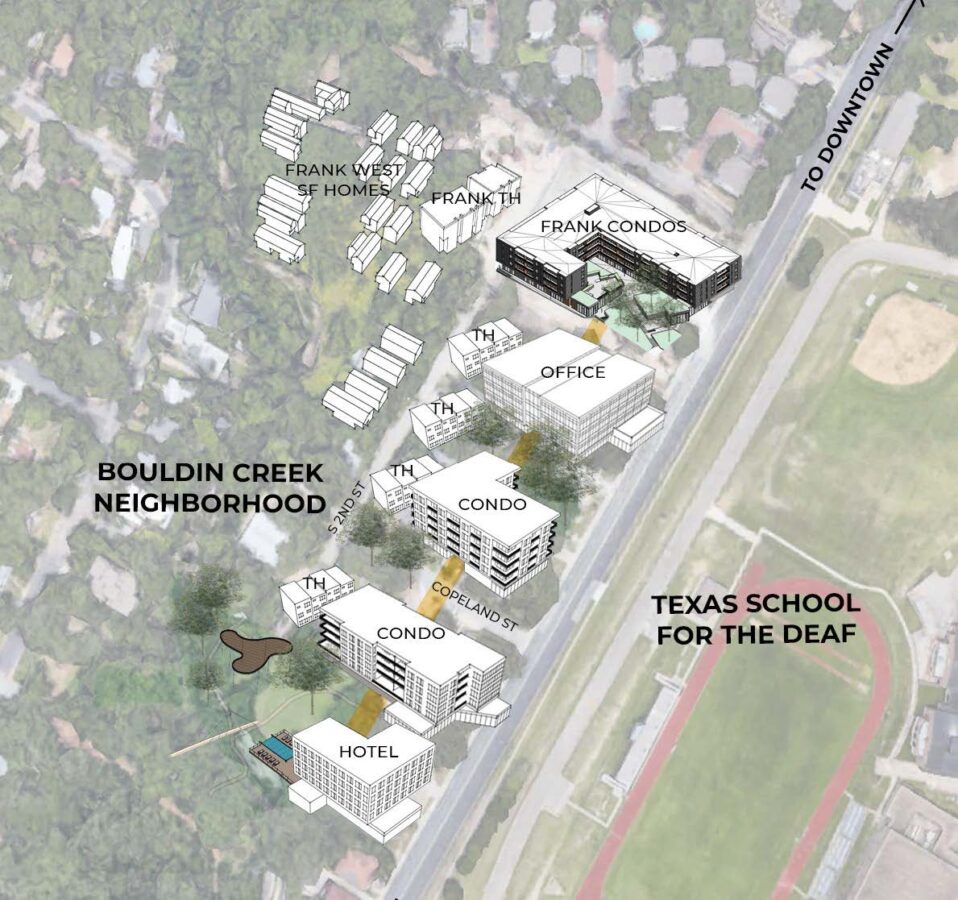

Site: 1002 S. 1st St, Austin, TX 78704

- Preferred Return – 12% per year

- Up to 800 Class A units at $5,000 per unit

- Minimum 20 units ($100,000) per investor

- Preferred Returns paid at the end of the project

- Long Term Capital Gain

Net Cash Flow Distribution

Net Cash flow to be distributed in the following order:

- Where proceeds are from a company

- Preferred return on capital invested in that company; then

- Return of capital invested in that company; then

- Same as general cash flow (see below)

- For cash flow generally

- Accrued but unpaid Preferred return; then

- Return of capital contributions, until investors are fully repaid;

- Remaining Net Cash Flow to the Class B Member.