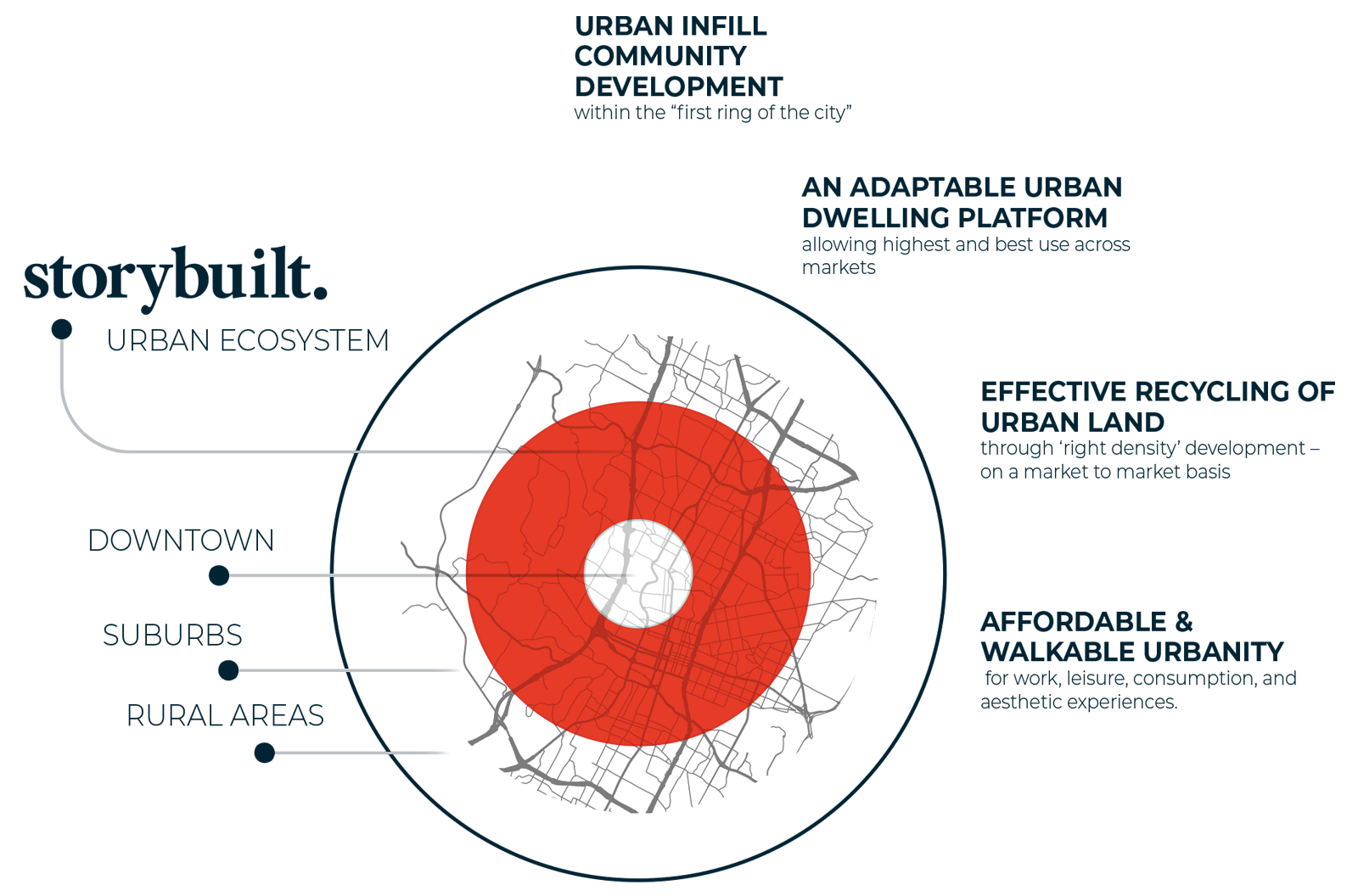

StoryBuilt is a developer, builder, and management company based in Austin, Texas. We specialize in urban infill, and strive to work sustainably. We started in real estate investments in 2001 and began investing in properties in Austin in 2006. StoryBuilt now works in Austin, Dallas, San Antonio, Denver, and Seattle. We’ve grown to 200 professionals who specialize in collaborative creation as we continue to design, build, and manage energy efficient, green urban communities.

Join us in this success trajectory.

OUR TRACK RECORD

20+ YEARS

development &

property management

>50

developments

>3,000

residences managed

$800M+

total revenue from our developments

18% EBITDA

margin over the past 8 years

HOW WE DO IT

- Vertically Integrated Business Model to Include In House:

- Smart Land Acquisitions

- Measured & Intentional Design

- Development

- Property Management

- Strategic Financial Partnerships

- Commitment to Building Thriving Communities in Desirable Cities

Development Mix

StoryBuilt’s $1.85BN pipeline of owned/controlled land will continue to expand their offerings of for sale and for rent communities.

2016-2025

| Actuals 2016-2020 | Forecast 2021-2025 | |

|---|---|---|

| For Sale Development | 300 M | 900 M |

| For Rent Development | 40 M | 800 M |

| Commercial Development & Recurring Revenue | 13 M | 300 M |

| Total | 353 M | 2,000 M |

| EBITDA Consolidated | 55 M (15% rev.) | 350 M (17% rev.) |

| Shareholder Profit | 40 M (11% rev.) | 160 M (8% rev.) |

| Residential Deliveries | 600 | 1,500 |

| Average Home Price | 500,000 | 600,000 |

| Average Rent / SF | $2.25 | $2.75 |

REVENUE STREAMS

Recurring Revenue from Vertically Integrated Property Management:

- Property & Community Management (3,000 units and growing – Leasing & HOA’s)

- Property & Customer Services (1,000’s of customers served)

- Property & Smart Home Technologies (*50,000 units under contract and growing)

Revenues from Development:

- Management Fees such as Design, Acquisition & Development, Construction, Sales & Marketing

- Investments such as our GP stake in each Development

- Net Operating Income from our GP stake in Rental Assets

For full past performance and future forecast information, contact StoryBuilt and refer to the company’s financial model.

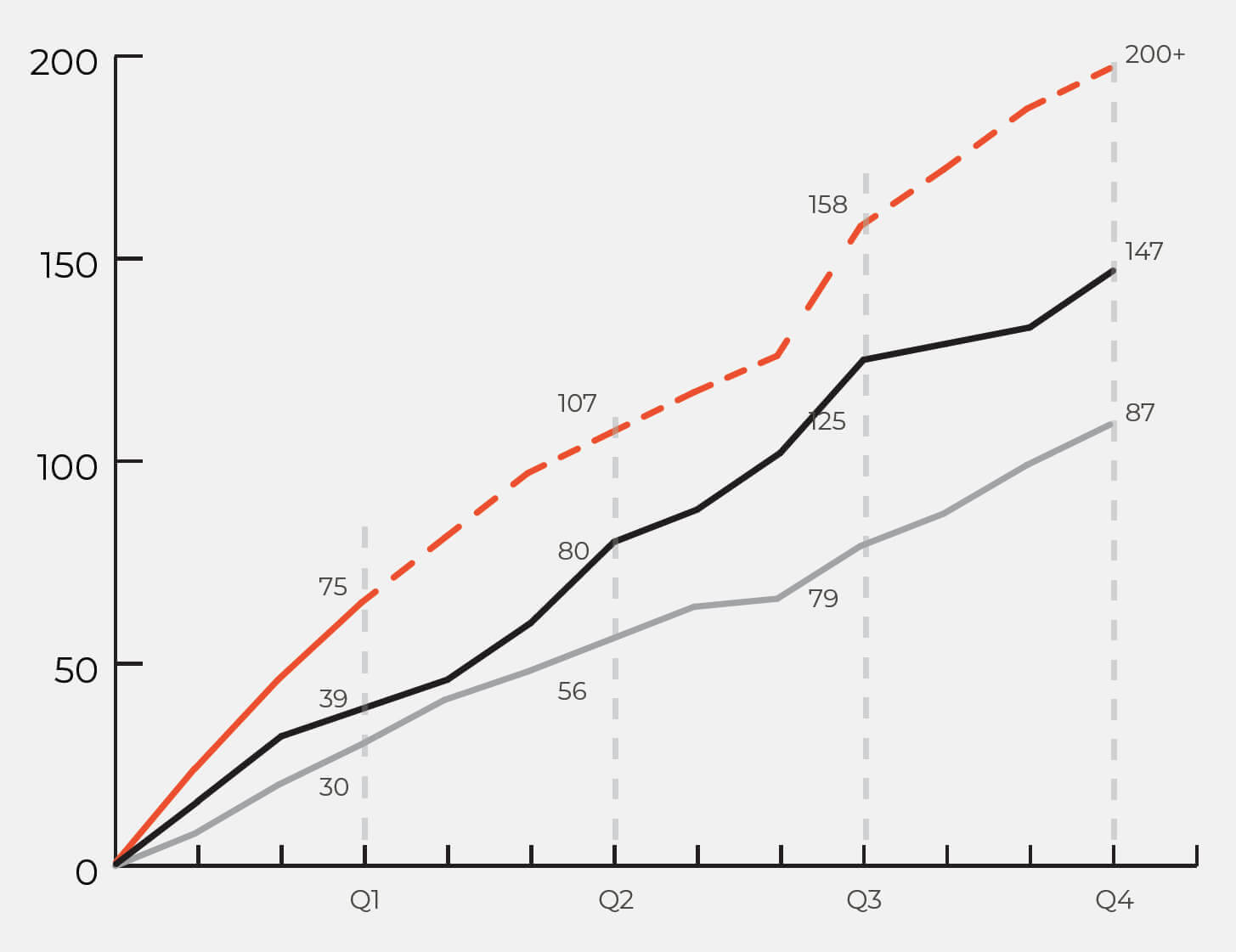

2022-2025

Additional Revenue Streams

2x Capital + Team

More Effective Capital

3x Pipeline

4x Revenue

5x Shareholder Profit

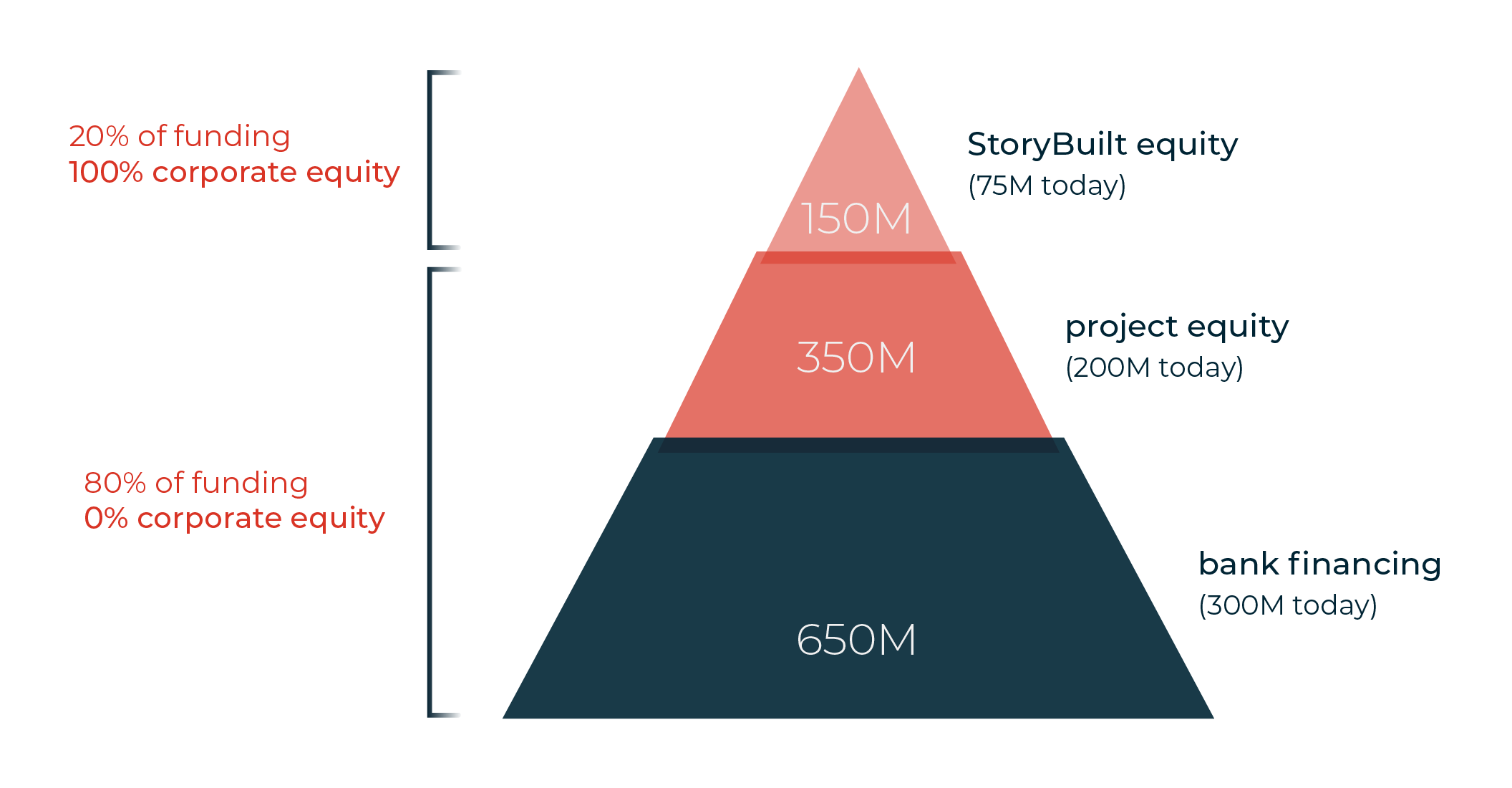

CAPITALIZATION PLAN

StoryBuilt is expanding its activities across more markets and combining property management, services, technology with managing developments, and real estate investing. This requires both institutional capital and individual investment to fund our integrated business plan.

Strategically utilizing institutional capital for the intensive real estate development ‘Project Equity’ bolsters StoryBuilt’s enterprise value and future exit opportunity for its Class A and B investors.

+$1B in funding = $3-4B in pipeline value

Creating a company value of +$2B

THE OFFERING[S]

CLASS A3 Preferred Equity

6% PREF + % COMPANY PROFITS ONGOING

10-25% LIQUIDATION PREF + % COMPANY EQUITY

Class A shares are available to accredited investors at $7,500/share with a minimum placement of $50,000 and held for a minimum of three years. Class A is a limited supply per StoryBuilt Company Agreement.

Targeted Return: 10-12% Annual Yield

Total Projected Return: 20%+ with Liquidity Event

Profits are distributed as follows:

- 6% Annualized Return (pref)

- % Pro Rata share of the remaining company profits.

Shareholders are also positioned to participate in any future exit opportunities such as a liquidity event with 10-25% premium floor.

Having a collective group benefiting from profit share, allows the company to be more conservative while having employee, owners, and leaders striving for the same goals and alignments.

ADDITIONAL OFFERINGS

Income Portfolio

Cash flowing asset

$100,000 minimum

Corporate Note

Short term cash flow

$100,000 minimum

Class B3

Aggressive return structure

$1,000,000 minimum

FORWARD-LOOKING STATEMENT

Our presentation may include predictions, estimates or other information that might be considered forward-looking. While these forward-looking statements represent our current judgment on what the future holds, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events.