Offering Summary

PSW Land Holdings, LLC (“the Fund”) objective is to acquire strategic land positions in Denver and Seattle to fuel the company’s growth while providing LP investors with a stable 12% preferred return and well-defined exit strategy.

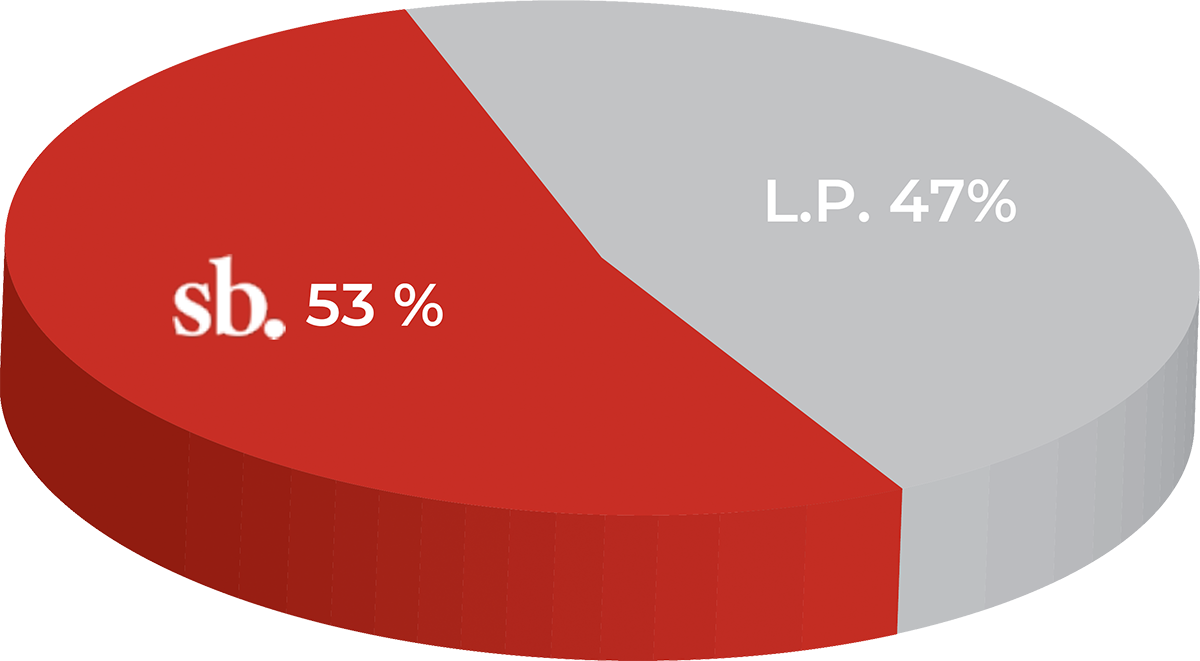

To that end, the Fund has raised $6,680,000 to date ($3.15MM from limited partners and $3.53MM from StoryBuilt) and invested in 3 highly desirable urban infill sites with estimated gross revenue in excess of $70,000,000. StoryBuilt’s own investment of $3.53MM in the Fund is a strong testament to the company’s belief in the long-term value of these assets.

Investment Terms

- Preferred Return – 12% per year

- Up to 5,000 Class A units at $5,000 per unit

- Minimum 20 units ($100,000) per investor

- Preferred Returns paid at the end of the project

Net Cash Flow Distribution

Net Cash flow to be distributed in the following order:

- Where proceeds are from a company (e.g. Stanley, Archie, etc.):

- Preferred return on capital invested in that company; then

- Return of capital invested in that company; then

- Same as general cash flow (see below)

- For cash flow generally:

- Accrued but unpaid Preferred return; then

- Return of capital contributions, until investors are fully repaid;

- Remaining Net Cash Flow to the Class B Member.